I first found about Scheid in a writeup from Aaron Edelheit. Scheid is the 33rd largest winery in the United States when measured by number of cases sold. Their vineyards cover approximately four thousand acres in Monterey county in CA, roughly half owned and half leased. They started as a wine grape grower in 1970s, then started making bulk wine in 1990s that other wineries could use to mix with their cased goods, and invested substantial money (~$75M) in 2000s to construct their own winery. In 2012, they started selling cased goods under their brands and under private labels, and quickly ramped to 500+ thousand cases by 2018.

The first thing that appealed to me about Scheid was the downside protection. 2018 appraised value of vineyards and winery (excluding inventory, Greenfield rezoned land, and vineyard equipment) was $190M. Add to it inventory for $60M (at cost), and Greenfield land re-zoned for residential / commercial use for $15M. Subtract out debt of $105M and we get value of $160M, compared to market cap of $60M.

Why such a big disconnect? For one, Scheid stock trades on OTC and is very illiquid. There are days when no shares trade. Second, the Scheid family owns 40%+ of the stock and hasn't been actively promoting the stock. None of this matters to me though due to the downside protection and significant upside potential. I'd be happy to own this for years without much movement in the stock price.

Before I talk about the upsides, it's useful to look at how wine business works. Sales follow 3-tier system with producers, wholesalers and retailers being different. Troy Carter of Motorcycle Wineries describes the distribution process - for a wine that sells for about $30 - as follows. Distributors buy cases of wine from the maker at $15 per bottle. They then sell it to restaurants and stores for $20. Restaurants’ markups vary, but stores consistently sell it for $29. Vacationers in Napa Valley will pay $30 to buy the bottle directly from the winery - it is something of a standard that bottles cost one dollar less at stores than at wineries, according to Troy. Supermarket chains like Costco, which is the largest provider of wine in the US, sell the bottle for around $22 - just above wholesale prices.

The first upside comes from selling more of finished goods, rather than bulk wine or grapes. Last year, according to Heidi Scheid (EVP of Marketing), the company sold 10% of what it grew as grapes, 60% as bulk wine to other wineries, and about 30% was bottled wine for Scheid’s brands. Scheid has crush capacity for 2 million cases, but currently sold only 517K as cased goods. If it sold all of the 2 million cases, revenue would be $100M per year assuming same price per case. That's probably $25M EBITDA per year and at 8X multiple, that's $200M.

What is needed to get there? First, Scheid has already done majority of the capex needed to sell 2 million cases. They now need to build a planned third bottling line, which has an estimated capacity of 1 million cases annually. Next, they need to continue to build their distribution network and their brands. There are similar California wineries outside of Napa valley that have ramped to 2 million + case sales: Bogle is one example, and there's no reason why Scheid can't repeat Bogle's playbook.

Scheid has already started making upgrades to their distribution network. They are switching to bigger distributors that will support the growth plans. For example, they switched to Young's Market (number 4 distribution in the US) for California in Jan 2018. Distribution is tricky - for a small winery a small distributor makes sense. But once a winery is at a substantial size like Scheid, it becomes important enough for big distributors to care about sales, and big distributors can provide the needed reach to expand sales. Scheid has also made progress on getting into big retailers and now has brands in 3 out of 4 top retailers of wine in the US -Albertsons/Safeway (#2), Kroger (#3), and Total Wine (#4). So one way to grow will be to start selling at the #1 wine retailer, Costco.

Scheid and retailers seem to be aligned on the move towards more private labels. They current sell the following private labels: Hive &Honey (Kroger), Ryder Estate (Bevmo)

and Mozaik at Benchmark Resorts. Private-label is a fast growing segment for wine in the U.S. has and has doubled since 2012, now making up 8 percent to 10 percent of domestic sales. But it has plenty of room for growth: private-label sector is approaching 30 percent in the U.K., and Brian Sharoff, the president of the Private Label Manufacturers Association, says it has reached 50 percent in some European markets. There are benefits for both retailers (higher margins, no competition with other retailers), and for Scheid (lower marketing spend).

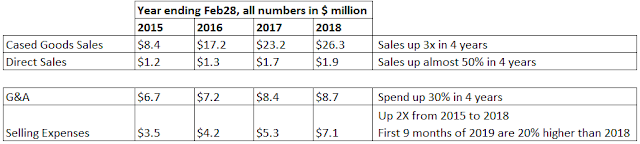

Scheid is also ramping sales org to support higher revenues. The chart below shows the increasing G&A and Selling expenses going up over past 4 years. A lot of the spend is going towards hiring sales managers for different US regions (highlighted in yellow). These new hires will take time to ramp the sales, but it's the blocking and tackling work that will (hopefully) produce higher sales.

The second upside for Scheid comes from building their own national brands and getting higher revenue per case (vs. $50 per case assumed in earlier valuation case in this article). Currently only ~100K cases out of 500K total cases come from their own brands vs. private label. Expanding on their own brands can give them higher revenue per case. Among the current brands, Vivino has favorable ratings on District 7 (sold at Safeway, Total Wine & More) and Ranch32 (was Bevmo exclusive, but now sells also through other stores: Total Wine & More, liquor stores). We tasted these wines and they offer good quality and decent price. There is a low chance that one of these brands hits it really big, though big hits like Meiomi are rare. Meiomi sold just the brand for $315M to Constellation Brands at 24X future earnings multiple. But we don't need such a hit to be successful. Again, something like Bogle with multiple varietals and high total volumes works just great.

The third upside comes from potential expansion of Direct to Consumer channel, though this is starting from a small base of $1.9M sales per year, and it's hard to grow direct sales fast. However, this is very lucrative because it helps to bypass the 3-tier system and allows Scheid to keep most of it's profits. The CEO Scott Scheid acknowledges the importance of direct sales in the latest annual letter. When we visited their wine tasting room at Carmel, it was packed with people and it was a fun experience. The hope is that they can convert more people into subscription wine club members with both high margins and repeat buying pattern. They could also expand their online sales and play a better social media marketing strategy to get direct customers and drive down marketing spend.

The risks are primarily illiquid stock, lack of clear timeline as to how value gets enhanced, and potential succession issues in family run businesses.