However, sometimes rollups make sense - when they deliver more value to customer, claim higher share of value in the supply chain, or when scaling up improves economics of each business unit. $EVI may be one such rollup. It's a rollup of laundry equipment distributors, led by Henry Nahmad who is a Watsco (HVAC rollup) alumni, and I'm long EVI.

Long runway:

EVI has a big TAM of several billions and there are atleast 100+ distributors for laundry equipment in the US and those make for future acquisition targets. Here's a relevant quote from 2018 Chairman's letter:

Ultimately, these products and services represent multibillion dollar industries, which we believe are addressable markets with attractive fundamentals and long-term growth prospects for our businesses.

The second vector of growth is to enter adjacent markets such as material handling, power generation, and water heating, purification, and recycling equipment, parts, and related installation and maintenance services. And lastly, they can expand revenue from services which currently is 20% of total revenue (Source: Dec 2018 10-Q).

"Right" Setup:

The most important aspect of the setup is that EVI can potentially create value for both supplier (national scale for distribution) and customers (one stop shop, insights on how to solve customer problems). Manufacturers get a lot of benefit from having one distributor that can sell across the country and that can bring insights on customer.

The other aspect of the setup is that there is hardly any competition from other buyers in the space for acquisitions. There's no auction driving up prices while buying.

To date, the owners of our ten acquired businesses accepted approximately 46% of the contractual consideration paid in EVI stock

Is buy and build strategy working?

This is the main question when evaluating EVI as an investment. The buy component is to acquire mom-and-pop distributors at decent price and the build component is to enhance the economics at each location level.

Let's start with the buy component. Table below shows all the acquisitions done till end of 2018. In my estimate, EVI has done a good number of deals and is making acquisitions at a good price of mid single digit multiples of EBITDA. (A bit more complicated take: they are paying half of the amount in stock - a stock that can potentially grow a lot in the future. But they are doing it to keep the owners interests aligned and using high EBITDA multiple stock to buy these businesses / locations)

How are these acquisitions performing once they are part of EVI? Let's start by looking at revenue picture. The table below shows the bridge from FY 2017 and FY 2018 revenue by estimating revenue contribution by looking at annual revenue prior to acquisitions. The actual revenue was about $3.9M lower than my estimate and most of the difference comes from Tri-State and Aadvantage. I don't think this is concerning because there can be timing reasons. For example, Tri-State was acquired end of October and it is likely that most revenue that quarter comes in October / November and less in December due to holiday season. Overall, I'd say that this estimate bridge matches actual quite closely and that revenue post acquisition has been inline with pre-acquisition revenues (And hasn't dropped off after the business sale). The buy strategy is working: in less than 3 years, EVI annual revenue run rate has gone up from $36M to ~$250M.

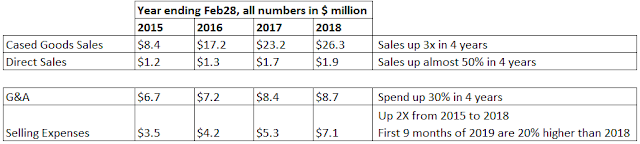

Now that we figured out the revenue picture, how about EBITDA/ profitability? Things don't look as good when looking at profitability (see table below).

But this table is not indicative of long term profitability. That's because just 2 years ago EVI had a single business (Envirostar) and they now need to spend money to build the corporate overhead groups first, before they can start growing earnings and profitability at each location. EVI 10-Q from December 2018 talks about these increased expenses:

As a percentage of revenues, selling, general, and administrative expenses for the six and three-month periods ended December 31, 2018 were 19.1% and 19.0%, respectively, compared to 17.7% and 16.7% during the six and three-month periods ended December 31, 2017, respectively.

Increases in selling, general and administrative expenses also reflect increases in expenses in connection with the growth of the Company’s market capitalization, which include but are not limited to greater accounting fees, legal fees, and insurance expenses. Further, in support of the Company’s buy and build growth strategy, the Company added key personnel, which contributed to increases in compensation expenses. Finally, the increase in selling, general and administrative expenses includes an increase in non-cash amortization expense related to the intangible assets the Company acquired in connection with its acquisitions and an increase in non-cash share-based compensation.

Net interest expense for the six-month period ended December 31, 2018 was $539,000 compared to $183,000 during the same period of the prior fiscal year. The increase in net interest expense is primarily due to an increase in average outstanding borrowings.

A summary of these increased expenses, excluding personnel, is shown in table below.

Regarding personnel hire, Nahmad had the following to say in 2018 Chairman's letter:

In connection with our growth efforts and the compliance standards applicable to us based on the increased size of our public company, our financial results also reflect investments at the corporate level, including costs related to adding experienced personnel and engaging national professional service firms to support our growing size and scale.

EVI's actions have demonstrated success in buying businesses at decent price. They have also shown initial signs of building corporate infrastructure. Where will they go from here? My guess is they continue to build capabilities that will in the future enhance economics of each location. They'll build ERP systems, central accounting and finance groups, sales training, and analytics to enable sales of more products and services via each location. They will share best practices, and solve problems for under-performing locations. The advantages of scale will start showing up: mom-and-pop small distributors can't advertise as effectively, or publish as often in trade publications as EVI. EVI due to it's size will also be able to attract the right talent, something that mom-and-pop distributors can't attract. Also, EVI will become more important to laundry equipment manufacturers and they will be able to cut better commission or exclusivity on products.

Once EVI is further along with building these capabilities, they should be able to get EBITDA margins easily in excess of 10% and more closer to 20% at each location level, mainly by increasing "utilization" at each location by pushing more sales with same number of resources. Such company building activities need time. See Watsco as an example: 30+ years later, they are still building some corporate capabilities with their tech accelerator program. EVI has the right setup to continue these "investments" on build strategy without having to worry about short term profitability. The key thing I'll continue to monitor is how EVI continues to "build", and some operational leverage related metrics (eg: Revenue per employee or Gross profit $ per employee).

PS: Some rough valuation: Revenue run rate is $250M/year currently. Let's say they keep doing 2 acquisitions each year at $25M Revenue per acquisition for next 5 years. They'll probably do more acquisitions, but let's assume only 2 per year. Let's also assume they add $20M per year revenue from sale for new products and services from existing locations. So 5 years from now, we get $600M annual revenue, and assuming 15% EBITDA margin gets us to $90M EBITDA. What type of multiple should we put on something growing at 15% CAGR? 10x? That will be $0.9B (vs. current $0.45B market cap). This is rough and there can be more acquisitions and more organic growth, and better mix of products vs. services. I like the odds here!

Would you mind sharing where you are finding these ebitda multiples at?

ReplyDeleteThis is very educational content and written well for a change. It's nice to see that some people still understand how to write a quality post! should i buy facebook reviews

ReplyDeleteThanks for the writeup.

ReplyDeleteI think it's useful to compare this to Watsco given that they had similar trajectories in the early years. I looked back, and Watsco in 1993 was about the size that EVI is now, at ~ $240 mil annual revenue. At that time, Watsco was valued at $50 million! EVI is presently valued at $290 million, and was $450 mil when you did this writeup. In other words, Watsco then was valued at 20% of revenue, and EVI is now valued at 1.2x...6x the valuation.

In 1993, Watsco was valued at a very modest 5x that year's EBIT. I have confidence that EVI will get margins up as they complete their technology investments and gain from scale. But I don't know if the roll up opportunity here is as good as well.

Also, Watsco EBITDA margins were only 8.2% last year, by my calculation, and they're a nearly $5 bil top line biz now.

That said, it really depends on the TAM and how much they can scale.