Sunday, April 21, 2019

Quick update on Drive Shack

Drive Shack ($DS) is a golf entertainment company and an upcoming competitor to Topgolf. TopGolf has been expanding rapidly and Cowen analyst recently valued it at $6- $7 billion EV (likely inflated because they used 11-13 X EBITDA multiple, but even if we take 5X EBITDA multiple, it's still $3 Billion EV). Drive Shack could be the second player in this market and potentially enjoy long growth runway. However, $DS is still in startup phase with 1 location open, 9 sites in the pipeline, and they are funding this growth by selling traditional golf courses they own. I haven't written about Drive Shack ($DS) in over a year (you can see the detailed thesis here). These have been some significant developments since then, and this article provides a summary of where things stand.

People:

1. They brought on new CEO Kenneth May in Nov 2018, who was previously CEO at TopGolf. While at Topgolf, he grew number of locations from 7 to 34.

2. Also brought on new CFO who was previously at Marriott and SBE.

2. The CEO has been busy and brought on many other TopGolf alumni : VP of Real Estate Development, VP of New Store Openings, Corporate Chef, Head of Marketing, and VP of Technology.

I like these changes because TopGolf has already figured out a lot of things on how to run golf entertainment sites efficiently, and getting people with those experiences into Drive Shack is the best way to accelerate the development of Drive Shack sites.

Significant progress on sale of golf courses:

Drive Shack's legacy business is in traditional golf courses (owned, leased or managed). The company's strategy is to sell all owned golf courses, get out of unfavorable leases, and focus on becoming an asset-lite, fee-only management company. An year ago, the company had not sold a single golf course it owned, but their Match 2018 estimate was that they could get between $200M to $325M by selling all of the 26 owned golf courses.

They have now sold 15 courses and have 6 in contract or LOI with total proceeds of $155M (See chart below). Their revised estimate is that the sale of all golf courses will give them between $220M to $240M, so on the lower end of their March 2018 estimate. But overall: good execution and this gives them liquidity to invest into Drive Shack sites.

They also retained management contracts on several of the courses they sold. This fee-only transition helps to get better cashflow. At the end of the sales, they expect that their traditional leased and managed golf business will do $10M of free cash flow per year.

Drive Shack eatertainment sites:

The first location at Lake Nona (Orlando), FL was opened in early Q218. $DS estimates that each location will give $25M to $25M annual revenue and $3M to $5M annual EBITDA. But two quarters after opening, in Q418, sales at Lake None were only $1.6M. What's worse is that its only 1% higher than sales in Q318. The new CEO made swift changes after coming onboard. The changes include: putting more focus on social entertainment rather than golf (Topgalf has the same strategy), and increased online targeting and higher event sales. To execute on this strategy at Orlando, they replaced the General Manager with a Topgolf alumni in Q119. In Orlando, the CEO guided on earnings call that they expect to breakeven this year and generate substantial revenue and EBITDA by next year. It seems like a reasonable timeline for results to stabilize. We'll have to wait to see the results.

There are 9 additional sites in development: 3 to be opened in 2019 and 6 more in 2020. It's highly likely that with the Topgolf alumni on board that they won't be able to successfully copy TopGolf strategy and deliver on their revenue and 25% EBITDA margin target.

The anecdotal data from Topgolf suggests that there is scope for Drive Shack to execute on this strategy. For example, Yelp reviews suggest that Topgolf in Orlando sometimes has hour to 1.5 hour wait times and so that drives people to go to Drive Shack. Another example is that TopGolf has indicated that they see meaningful expansion opportunities across US cities. It's highly likely that TopGolf won't have the financial or operational bandwidth to execute on all of their grand plans on expansion, and Drive Shack can pick up a lot of wins.

Bottom line:

$DS has the cash from sales of traditional golf courses and has the team with the experience needed to launch new sites. I don't see any reason to update the valuation estimates done in the past and believe that the stock price may move up significantly in the next couple of years.

Subscribe to:

Post Comments (Atom)

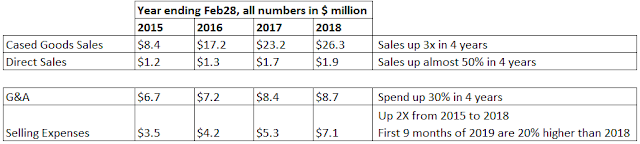

Scheid Vineyards (SVIN) - substantial upside potential

I first found about Scheid in a writeup from Aaron Edelheit. Scheid is the 33rd largest winery in the United States when measured by num...

-

I previously wrote about Marty Whitman's insights on Value Investing . One key insight is to focus on what the numbers mean and not ju...

-

I first found about Scheid in a writeup from Aaron Edelheit. Scheid is the 33rd largest winery in the United States when measured by num...

-

Yatra is #2 OTA in India and listed on Nasdaq via SPAC in 2016. I first started buying it at ~$10/share after reading Dane Capital and Gr...

No comments:

Post a Comment