I recently re-read Marty Whitman's book - Value Investing, A Balanced Approach. Whitman's writing is a bit academic sounding and hard to understand, but his insights are amazing. I find that his ideas on creating wealth and resource conversions provide an investment edge because these ideas don't screen well. Whitman says that earnings are not the only form of wealth. A quick way to understand this is Paul Graham's example of creating wealth by fixing a beat-up old car. There are no earnings if this car is not sold, but wealth or economic value has been created. Similarly, Whitman explains how companies can create wealth in tax efficient manners.

Here are some key points from the book:

1. Focus on what the numbers mean, not what the numbers are

Whitman says that GAAP earning is a starting point and is an accounting tool, and is not meant to capture economic reality. His advice: Start with earnings and make adjustments to account for economic reality. Whitman is NOT advocating for accepting adjusted earnings as peddled by management, but to create one's own estimate of earnings that mirror economic reality.

Here's one example from the book to illustrate the point of focusing on what numbers mean: Forest City Class A shares in 1991 were selling for $20/share though the annual report stated that the appraisal of income producing assets alone came to $80/share. The disconnect existed because real estate environment was depressed and Forest city reported GAAP losses. The earnings were depressed due to depreciation and amortization for accounting purposes. In reality, the value of the buildings was increasing.

My previous investment $FRPH (now sold) reported GAAP losses in almost all quarters, though they were significantly enhancing value by putting land parcels to higher use (i.e. resource conversion) either as residential buildings or industrial warehouses. The owner operators - the Baker family - didn't prioritize earnings but were focused on lowering taxes and enhancing economic value via resource conversion.

Another example given by Whitman is that GAAP Current assets maybe more like fixed assets in case of going concerns (Eg: Sears inventory is almost a fixed asset if it needs to be in business), while Forest Cities can sell fixed assets such as Class A building by placing a phone call, so this fixed asset is more like current asset in terms of economic reality.

Fast growth software companies present similar challenges when using GAAP earnings. One of my current investments - $GAIA shows big losses on income statement because they are spending lot on marketing and acquiring new users. This marketing spend is expensed by GAAP rules, though it in reality this spend is similar in nature to growth Capex. $GAIA is creating wealth but its not visible from the income statement.

2. Incorrect and excessive focus on earnings

Whitman attacks Wall Street's obsessions with reported earnings. Earnings are volatile and yet they are treated as the most important item when Wall Street looks at companies. He explains that private owners of business create economic wealth while minimizing taxes by reducing earnings.

3. Resource conversion = converting assets to higher use

Whitman maintains that this is the most common way of creating wealth. Resource conversion includes redeployment of assets to other uses, to other ownership, or both.

Examples are:

1. New ownership which will pay considerably higher to acquire the company (eg: M&A, LBO)

2. Use of existing asset base to create large new NAVs (eg: Forest city, Tejon Ranch, St Joe)

3. Use of existing asset base to realize markedly improved earnings and ROE during next up cycle, eg: US semiconductor equipment stock, Tecumseh Products stock

Companies go through M&A, spinoffs, recapitalizations, MBO, LBO, etc quite often and yet the market mostly focuses on analyzing companies only as going concerns and not as resource conversion opportunities.

At the most basic level, Whitman is asking value investors to look at companies from the lens of private, control owners and not just minority stockholders.

4. Management = operators + investors

There is overemphasis on the role of management as operators, but not enough as investors. If one considers that resource conversions happen often during a company's lifetime, it follows naturally that management's role as investors is as important as their role as operators.

5. Balance sheet strength can translate into cash flow strength

A strong balance sheet can be a source of strength and lead to improved cashflows in the future.

Whitman gives example of Nabors post bankruptcy where there was no debt on the balance sheet in mid 1988. Other oil service companies at that time were burdened with lot of debt. Nabors used its financial strength to buy contract drillers and contract driller assets at cheap prices because they were the only ones bidding. The result was that cashflow from operations went from loss of $20M in 1987 to positive $200M in 1997.

6. Access to ultra cheap financing can be a source of value

Wealth can be created by access to cheap source of capital. Examples are banks and well managed insurance companies

Subscribe to:

Post Comments (Atom)

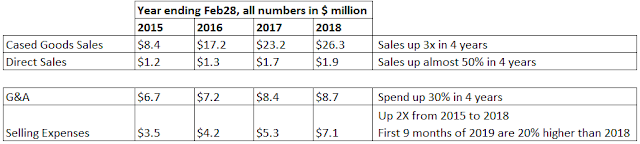

Scheid Vineyards (SVIN) - substantial upside potential

I first found about Scheid in a writeup from Aaron Edelheit. Scheid is the 33rd largest winery in the United States when measured by num...

-

I previously wrote about Marty Whitman's insights on Value Investing . One key insight is to focus on what the numbers mean and not ju...

-

I first found about Scheid in a writeup from Aaron Edelheit. Scheid is the 33rd largest winery in the United States when measured by num...

-

Lately, I’ve been thinking about middlemen businesses. The Private Investment Brief wrote this thought provoking article on middlemen a...

No comments:

Post a Comment