Yatra is #2 OTA in India and listed on Nasdaq via SPAC in 2016. I first started buying it at ~$10/share after reading Dane Capital and Greenhaven Road Capital letters talking about Yatra as an undervalued way to play the India market.

Recently, YTRA stock price dropped to ~7/share range and I doubled my investments in YTRA because it offers asymmetric risk / reward ratio at current price.

First, some color on India Travel Market:

The Indian air travel market is the fastest growing market in the world (16% CAGR in 2017) and is currently #3 in terms of size (after US and China). Over the last 10 years, during my annual trips to India, I've been amazed by the improving quality of airports and better air connectivity. And many middle class Indians have started traveling by flights due to higher paychecks, increased air connectivity with tier 2 cities, and introduction of domestic budget airlines. In addition to the general increase in # of air travelers, there's also a move from offline to online booking of air travel and hotels. However, the per capita spend in India on air travel is only 20% that of China, which hints towards continuing growth.

What's driving the low prices?

1. SPACs have a bad track record, and so Yatra is being clubbed with other "bad" SPAC investments.

2. Major investor (20%) - Norwest Ventures - recently sold off their holdings. It seems that this VC fund reached its life of 10 years and so the stock was sold / returned to LPs. This seems like forced selling.

3. Limited analyst coverage (3 analysts)

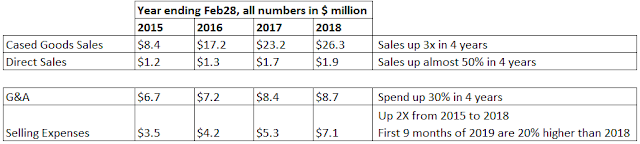

4. Yatra is currently making a loss because of heavy spend on sales and marketing as they try to scale up. However, they have enough cash to continue at current burn rate for 2 years. They plan to breakeven by end of 2019.

What makes Yatra a compelling investment?

1. Yatra grew 40% Revenue year over year while increasing EBITDA 100%. And yet it sells at 1.4X Rev (assuming Q417 Revenue annualized).

2. Its way cheaper than competitors. MMYT trades at 3.6X Rev (assuming Q417 Revenue annualized). MMYT bought competitor goibibo at 8X Rev, while YTRA acquired Air Travel Bureau (ATB) for 1.8X Rev. This also shows the capital allocation discipline shown by YTRA.

3. Hidden asset in terms of partnership with Reliance (major stockholder). Reliance will install Yatra app on all of its Jio smartphones, effectively increasing the install base by factor of 3x. For those not familiar with India Market, Reliance is huge and is known to win in the markets they enter, and smartphones are the new market for them.

What is range of value for YTRA?

To determine a lower bound for the valuation, let's assume that Yatra grows only at the average OTA rate of 12% (unlikely given high growth in India, but still useful to get a lower bound). Also, I assumed a lower multiple due to lower growth.

Value = 2 x 2020 Revenue less service cost + Cash from warrants - Cash burn =

2 * $153M + $280M - $100M = $486M

# of shares = 24M outstanding + adding 17M shares from warrants = 41M shares

Value = $486M / 41M = $11.9/share, implying good downside protection.

For a more realistic estimate on value, I refer to estimates from other value investors:

a. Dane Capital's estimate of value = 5 x 2018 Revenue Less Service Cost = 5 x 98 = $490M

Value = $20 / share

b. Scott Miller's valuation:

Assuming 20% year over year growth:

4x 2020 Revenue Less Service Cost + Cash from warrants - Cash burn =

4 * $170M + $280M - $100M = $780M

# of shares = 24M outstanding + adding 17M shares from warrants = 41M shares

Value = $780M/41M = $18/share

So the range of value is $11.9 / share - $20/ share.

Multiple shots at the goal in terms of unlocking value:

1. Market re-rates

2. YTRA continues on the growth trend, adds new users at minimal costs due to network effect and turns a profit

3. YTRA acquires other smaller players (Eg: Cleartrip) and gains more size

4. Global players acquire YTRA to get a foothold in the India market. Expedia will be a good candidate here.

What is Mr Market missing?

1. Online travel in India need not be winner takes it all, but Mr Market is pricing MMYT and YTRA as such. MMYT is priced at ~10X higher than YTRA though MMYT's market share is only 2.5X higher.

2. Though MMYT has big backers (Naspers, Ctrip) and big cash stockpile, we think that Yatra will continue to grow because a. the India market is big enough and growing, and b. Yatra's strategic partnership with Reliance.

3. There can be multiple winners if they have different focus areas. Example: MMYT can win in high end hotel space, while YTRA can win in its focus areas - corporate air travel and budget hotels.

I'm fairly certain you share count is wrong. I think there are about 36m shares outstanding with the with the warrants exercise-able for another 17.4m. Go check out note 28 and 29 to the 20-F. The weighted average is thrown off because the SPAC transaction took place in Dec 16 and the 20-F is for the year ended Mar 17.

ReplyDeleteIn any case, I agree with your conclusion. This business seems very miscpriced to me. It's hard to know what percentage of marketing & promotion spend is absolutely necessary to keep the business healthy and what is growth investment. But at the current growth rate, spending this much on brand marketing is exactly what you should want to see as a shareholder.

At ~30% growth the EV will be less than 1x Revenue Less Service cost in 3 years (if the stock price doesn't move). For a business that spends 50% of their revenue on marketing that is arguably discretionary and can be flexed up or down, that seems pretty cheap to me.

Think the warrants will be anywhere from 0%-25% dilutive if management decides to use the cash to buy back the shares issued for warrants. Warrant are likely a compelling investment in themselves, but probably not a bad idea to buy as a hedge to dilution

DeleteAndrew,

Thanks for your comment!

The first page of 20-F says "As of March 31, 2017, 23,803,803 ordinary shares, par value $0.0001 per share, 6,865,676 Class A non-voting shares, par value $0.0001 per share and 3,159,375 Class F shares, par value $0.0001 per share, were issued and outstanding".

-----> This totals upto 33.9M Shares. It seems like I only took the 23.8M number.

Then Note 28 again shows that the outstanding shares as of Mar 2017 are 33,828,856.

Not sure how you got to 36M shares. if I take 33.8M shares + 17M warrants, I get value range = $9.7 - $15.5. Still looks good as an investment.

I agree that it looks cheap given the growth and EV to Rev ratio.

Hi,

ReplyDeleteThanks for the write-up. Well, how you got the 280M Cash from warrants? Shouldn't it be 17M*11.5=200M ?

Do you know people in India who have first experience using Yatra's services ?

ReplyDeleteI live in China and I use Alibaba and JD's services.

So, I have more confidence investing in those companies.

Good Blog with good Pictures, i really like it.We provides Good Blog with good Pictures, i really like it.We provides Tempo Traveller on hire Tempo Traveller in Delhi ,Tempo Traveller in Gurgaon , Tempo Traveller on rent in Noida , Tempo Traveller on rent in Ghaziabad , Tempo Traveller on rent in Faridabad , Tempo Traveller,Tempo Traveller rental faridabad,Tempo Traveller rental gurgaon,Tempo Traveller rental Ghaziabad,Tempo Traveller hire faridabad,Tempo Traveller hire noida ,Tempo Traveller hire Ghaziabad for easy travel.

ReplyDeleteMost of the times the values go above my head but this blog was interesting any ways!

ReplyDelete:)

Keep up with your good work.

paycheck stubs

check stub maker