Drive Shack (DS) is a golf operator, formerly known as

Newcastle Investment (NCT) and is managed by Fortress. NCT was previously an REIT

that owned senior care facilities and made debt investments. Over the last few

years, they spun off senior care REIT and are now in processing of monetizing

all their debt investments. Starting Jan 1, 2017, they are no longer REIT and

cancelled the dividend. They are now focused on being a golf owner / operator and

are touting new concept of golf entertainment called Drive Shack – which will

be similar to Topgolf.

The cancellation of the dividend led to “forced sellers”

– REIT investors moving to other greener pastures for dividends. The stock

currently trades at market cap of $198M. DS has preferred stock worth $60M and

debt worth $160M. They also have cash of $130M and expect to realize $110M from

monetizing legacy real estate debt. Netting all of this, the market is pricing

golf business at EV of ~$180M. I’ve excluded golf member’s deposits from

liabilities because these are long term (30 years) and are not typically

refunded.

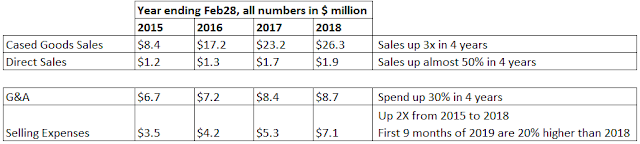

The golf business - American Golf Corp history – was

acquired by DS via debt to equity restructuring in Dec 2014. Golf courses have

hard time getting financing since 2008 with typical rates at LIBOR + 4%. This

is because there is clearly headline risk in golf – lack of new players, high

fixed costs (mowing lawn and water) , glut of golf courses built in 90’s and

early 2000s, and re-zoning golf courses into housing is tough due to deed

restrictions and home owner opposition, etc.

American Golf Corp makes EBITDA of $30M, and assuming 8x

-10X EBTIDA we get EV = $240M to $300M, implying 25% - 40% discount to price of

$180M. This EBITDA multiple is based on

ClubCorp’s acquisition of Sequoia golf in 2014. This valuation ascribes no

value to future EBITDA growth from the new Drive Shack concept.

DS will start operating first location for Drive Shack in

Q118, based on proven concept from competitor TopGolf. These locations will

provide technology assisted driving ranges with entertainment, food and

beverage options. Management expects that each location will need investment of

$15M-$25M and will produce $3M - $6M of EBITDA. This is in line with estimated

performance of Topgolf locations. Drive Shack also has the second mover

advantage – they can learn from what works at Topgolf.

The downside is limited due to existing value from cash and

American Golf Corp, and there’s a big potential upside if development of Drive

Shack locations goes per plans. Its hard to put a number to the upside from

Drive Shack. If the new concept is not successful, DS can stop developing

additional locations and sell the Drive Shack locations to TopGolf. All of this

creates an asymmetric risk – reward scenario here.

Catalysts:

There multiple shots on the goal for realizing value for DS:

There multiple shots on the goal for realizing value for DS:

1.

Growth in Drive shack concept

2.

DS could sell traditional golf business to get

cash and focus only on drive shack locations

3.

Some golf courses could be developed into Drive

Shack locations

4.

Market re-rates stock as new stock buyers see

the value

Fortress Chairman Wesley Edens (also chairman of Drive

Shack) recently bought $15M of stock.

Risks:

1.

Traditional Golf courses decline more in

revenues, and operating leases can’t be broken easily. There’s sizable

operating lease liability. But it is possible that DS can negotiate lease

breakup fees which are lot lower than paying all remaining lease liabilities.

2.

Characteristics of a PE investment, and likely

to take 3-5 years to realize its full value

3.

Realization from legacy real estate debt is lot

less than management estimate of $110M

Disclosure: I own shares of DS

No comments:

Post a Comment