Lately, I’ve been thinking about middlemen businesses. The

Private Investment Brief wrote this thought provoking

article on middlemen and why they exist. I've made several investments in middlemen companies - $LNG (toll operator for liquified natural gas), $EVI (distributor of laundry equipment with rollup strategy, $YTRA (#2 OTA in India). LNG and EVI thesis have played out well, while YTRA has been plagued by baffling capital raising decisions by management (25% dilution at $5.5/share. My cost basis ~$7.5/share). This post focuses on investment initiated last week - AINC - middleman / asset manager for AHT and BHR.

I think middle men definitely provide value, and they charge fees for that. But sometimes middlemen can also extract value from the ecosystem, which can be a good or bad thing

depending on where you stand. An example: Warren Buffett recently commented

that real estate agents (middlemen) provide valuable services especially for

first time home buyers. I have the opposite opinion : realtors are extremely pricey middlemen that don't provide value for the high $ commissions in high cost regions, especially now that Zillow and Redfin provide so much search data. Buffett gains

from the realtor fees from Berkshire Hathaway HomeServices, while I lose on the

fees if I buy a house. How we think of middlemen depends on where we stand.

Now on to Ashford Inc Ashford Inc

(AINC) – the asset manager for Ashford Trust (AHT)

and Braemar (BHR). I first found about Ashford Inc from Greenhaven Road Capital's Q118 letter to investors. The basic thesis is that AINC is the vehicle for the CEO (actually the Bennett family) to extract value from AHT and BHR. Again, how we think of middlemen depends on where we stand. So if we stand as investor in AINC we can benefit, while shareholders of AHT and BHR might lose (gain and loss are relative terms here).

Stable base fees and onerous termination clause

AINC is setup to extract fees

from AHT and BHR. Its the vehicle for Bennett family to extract more value for

themselves. AINC provides management services for Ashford Trust and Braemar

based on contract that has onerous termination requirements (atleast 12 times

net earnings from each of the REIT, among other conditions). Such onerous

termination clauses make the base fees a stable revenue source.

Base fees 0.7% of Market capitalization (where Market capitalization includes both equity and debt)

Incentive fees 5% * TSR outperformance * Total equity

2017 Base fees: $34.7M (Ashton Trust)

and $8.8M (Braemar)

2017 Incentive fees: $1.8M (Ashton

trust) and $1.3M (Braemar)

Ashford Inc shown as New Holdco

in this diagram

Where is Bennett family money tied up?

The upside comes from the fact

that Bennetts can increase assets under management for AHT and BHR and increase

the fees they get from AINC. This seems easy to do since they manage all three

entities – AINC, AHT, BHR.

Another useful check if AINC

earnings are Bennett’s top priority is to check which entity has most of their

capital tied up. Among the public companies that they manage, Ashford Inc is

their biggest asset, i.e. their main vehicle to grow their riches. Post Remington

Project management transaction, the Bennetts will have $225M tied in AINC ($22M

stock + $223M in convertibles) vs $70M in AHT and $16M in BHR.

Remington Transaction:

The Bennett family privately owns

Remington Holdings LP – property and project management company – that Ashford

Inc tried to buy in September 2015 for $321M (combination of stock and

convertible). But Ashford terminated the merger agreement in Mar 2017 because

it was not able to get favorable tax ruling (private letter ruling). In April

2018, Ashford Inc announced plans to acquired only project management portion

of Remington for $203M in form of convertibles with convert price of $140. This

acquisition is not contingent on favorable tax ruling.

Shares outstanding = 2.1M

Current Bennett ownership = 0.3M

Shares from converts = 1.45M

Bennetts will own ~50% of the

company after Remington Project Management acquisition. They benefit a lot from

this transaction – rich valuation on project management business.

Valuation:

Adjusted EBITDA = $17.4M (from AHT and BMR base fees_ +

$4.5M (From J&S full year) + $16M (from Remington project management) = $38M

EV = $130M (market cap) + $203M (convertible for Remington

project management transaction) - $34M (cash) = $229M

EV / EBITDA = 7.8

While this seems okayish, there are plenty of levers on growing

the earnings here. Further, there will be positive impact on earnings from

lower tax rates.

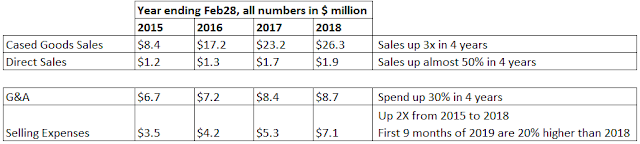

Earnings Growth levers:

- Ashford Trust and Braemar acquire more hotel assets via debt or equity issuance

- Ashford Inc expands J&S audio across its entire portfolio

- Pure Rooms and OpenKey growth adds to bottom lin

- Ashford Inc acquires more hotel middleman services

- AHT or BHR acquire another hotel REIT since that area seems ripe for further consolidation

Risk:

The

risk is further dilution by Bennetts who might enrich themselves at expense of

minority shareholders. This could happen if AINC decides to acquire Remington asset

management portion, which is likely to be $100M+ transaction based on previously abandoned deal.

What do you think about Ashford's agreement to provide $50 million to AHT?

ReplyDeleteAshford Inc. has committed to effectively fund amounts equal to 10% of the purchase price of Ashford Trust hotel acquisitions. They referred to this as "key money" program in their investor slide deck in the past so it wasn't a surprise.

DeleteIts another way to boost assets of AHT and generate more base management fees. This might also boost share price of AHT which will enable AHT to tab equity markets again which again leads to higher base fees for AINC.

Right, I get how it could still earn a positive return for AINC if it was a make or break situation. But wouldn't it make more sense for AINC to provide a loan to AHT, or to seek a higher rate of fees for that specific set of hotels? If they wanted, AINC couldve just bought their own hotel and kept the entire profits for themselves.

DeleteIt seems slightly strange to me that AINC would just give away the money, even if they expected to collect higher fees.

I think of this deal as a net positive for AINC.

DeleteAINC got management contract update as part of this ERFP program. AINC still keeps the base management fees if AHT sells any hotel assets - so there's further downside protection now.

AINC provides funding and buys Furniture, Fixtures and Equipment (FF&E). Your points are good - why not buy hotel directly or structure it as loan?

AINC's model is to not buy hotels, its a fee collector (middle man). As to why they didn't loan the money to AHT? My guess here - if AINC funding was structured as loan, the interest rate on the other debt taken by AHT to buy hotel properties might be higher.