I ended 2018 with -8.5% loss compared to -6.2% loss for S&P500. I play mostly in microcap area which sustained steep losses in Q418. My own portfolio wasn't spared in Q4 either. This is a quick recap of 2018 yearly performance and some learnings.

I can't predict macro stuff for 2019, but I feel cautious mainly because of where we are in the cycle (10 year expansion, ultra low interest rates now going up, etc). But as Howard Marks says - "we don't need to know where we are headed, just where we are in the cycle". So, I'm trying to be cautious and my strategy is to stick with financially strong companies and avoid excessive leverage.

Closed positions:

FRP Holdings (FRPH) - This was a good winner in 2018 and I previously explained why this was a good investment here. They did resource conversion in the classic manner as described by Marty Whitman. They converted a concrete batch plant to apartment building besides Washington Nationals stadium, and sold off warehouse business that they created from scratch for high valuation. I might look to get back into this stock again in the future depending on price and the Baker family plans on further resource conversion opportunities.

Yatra (YTRA) - This was the biggest mistake of 2018 for me and I took 35% loss on this 5% position. I got suckered into $YTRA and the thesis was an unforced error. It was focused too much on the upside and not enough on the downside (torched marketing $s). Again, this is one case that will always remind me to never use price to sales ratio ever again. Yatra is growing, but their marketing spend is just not efficient relative to revenue added. And they are in race to bottom to acquire users with MakeMyTrip. This was also a good wakeup call to not touch SPACs and just have error of omission. The problem with SPACs is similar to that of IPOs - prior owners find opportune time to cash out and find other (bag)holders. Yatra was the same story.

Keryx (KERX) - This was my first biotech investment, but was relatively lower risk since Keryx already had a FDA approved drug. So the only question was whether they can sell enough of the drug. I kept position size low at 2%. I entered into this position when Keryx had manufacturing yield problem at a contract manufacturer and supply for disrupted for a month. However, Keryx could never ramp up sales fast enough and announced sale to Akebia. I exited it with a minor loss and probably won't be back in biotech since it's not worth the effort.

PBF Energy (PBF) - This was another winner in 2018. They bought refining assets for cheap and were turning around operations in PE style. As Whitman says, when there are resources with good quality and quantity, eventually earnings come around. There's natural ebb and flow in demand, but no new refining capability is being added. So earnings went up for a short period in 2018 and stock price shot up. I sold it when it seemed fairly valued in mid 2018 and the price has come down by ~30% since then. Might be worth another look if price keeps dropping to mid 20s.

Open positions:

Resolute Forest Products (RFP) - I bought most of my stake in $4 - $6 range. The basic thesis was that they have high quality assets and were severely undervalued due to making operating losses in 2015 - 17 period. But earnings typically follow when there are good assets. And 2018 saw lumber, pulp and paper prices all rise up due to high demand. Supply can't be created fast enough and RFP stock price shot up to close to $13. I sold off 1/2 of my stake at that price, and still hold the rest. The stock has done a round trip and is now at $7 where I believe it's very undervalued. Much of the drop seems related to softwood lumber prices dropping down from 2018 heights and back to level to Jan 2017. But the selling seems overdone since pulp and paper prices are still high. Also, RFP did some asset sales which will reduce debt, and is doing close to 50% FCF currently. Finally, if their tissue segment starts producing earnings (a big IF), this will look a completely different company.

Drive Shack (DS) - When I first bought Drive Shack, they had cancelled REIT status and there was indiscriminate selling. They are doing resource conversion - selling golf courses and investing proceeds into Topgolf like eatertainment arenas (detailed thesis is here). My purchase price is in $3 range and $DS shot up to > $6 on news that Wes Edens bought a big stake at $6. The stock has dropped back to < $4, though they have executed well on golf course sale (12 sold out of 26 courses for $89M). They are also retained management of these sold courses which means they will get to keep fixed fee earnings. They recently hired Topgolf ex CEO as $DS CEO. It's too early to tell if the Drive Shack concept will be as profitable as Topgolf, but atleast there's existence proof.

Cheniere (LNG) - I've held it for past to 2 - 3 years. The basic thesis is that they are toll road operators for LNG. They have high leverage but long term contracts reduce the risk. And their earnings keep going up as additional trains come online.

Antero Resources (AR) - Biggest paper loss came from Antero. I did a long write up here, but the stock slid almost 50% just in Q4. I've re-looked at the thesis and don't see anything majorly wrong with it. Yes, the paper loss is painful, but this is an undervalued company. Management has announced corp structure simplification, and share buyback. No time like now to buy back some shares when they are so undervalued.

Ashford Inc (AINC) - No change in the thesis written here. This has the same setup as RMR, and the Bennett family has converts at $140/ share. They have the incentives to do transactions to raise stock price and get those converts in the money.

Fiat Chrysler (FCAU) - There's still lot of value left to be unlocked as they continue to ramp Jeep and Ram, divest parts business (Magneti Marelli), and extract value for luxury brands - Alfa Romeo and Maserati.

Gaia (GAIA) - Detailed thesis is here and nothing has changed except drop in price. Very niche business, but potential to be a multi bagger. The stock price did a round trip and is now roughly close to average price I bought it.

TripAdvisor (TRIP) - Great assets that need to be monetized better. Either they will do it, or will be sold to another company that can monetize it better. This contributed to a gain in 2018.

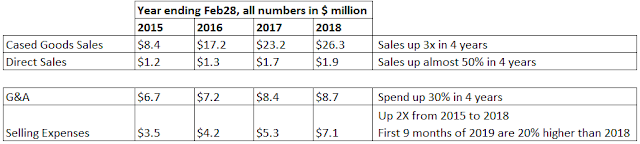

Envirostar (EVI) - Rollup story with Watsco alumni management owning > 50% of the stock. It has great potential to be multi bagger similar to Watso and $POOL. They can continue making acquisitions since there's not much competition. And they can increase profitability by cross selling and focusing more on services.

Passur (PSSR) - It's a tiny data analytics company that provides services to airlines and airports. They have ramped spend on sales and marketing, but revenue hasn't gone up. This is a bet that either revenue goes up, or spending is cut. Either way, earnings will follow.

Rubicon (RBCN) - They have lot of NOLs but have sold off their loss making operations. I am confident that Bandera Partners and CEO Tim Brog will repeat their prior performance and unlock value here in next 2-3 years.

iStar (STAR) - They have a hodge podge of real estate assets, and they seem hell bent on being a developer instead of simplifying their balance sheet and staying only as a lender. In the two years I've held this stock, they haven't made much progress to unlock value, and it might stay the same for another 2-3 years.