Passur was a profitable company from 2006 to 2016 and derived it's revenue from these sources:

a. Hardware: selling passive radars - small but declining revenue source

b. Services: Consulting with airports, airlines or FAA

c. SaaS portion: Software sold to top 5 airlines and top 30 airports in the US.

Based on review of publicly available contract documents for airports, this SaaS portion is very sticky. Airports and airlines use Passur software to track arrival and departure plane positions, as a communicator tool and for landing fee billings (plugs into Oracle ERP for auto billing). Few examples: Denver airport has paid ~$100K/ year for last 14 years, Tampa airport has contracts from 2012 to 2023 and pays ~$50K/ year. Many of these contracts show the services are sole sourced.

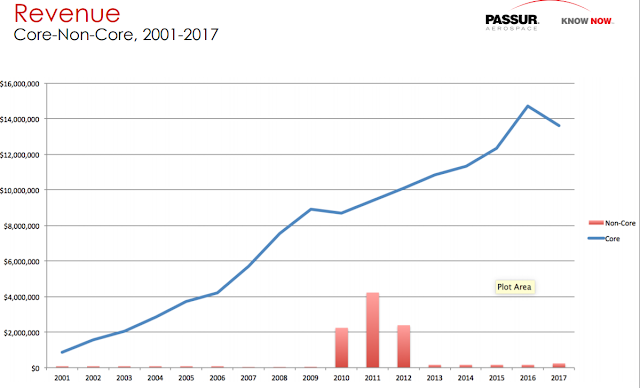

To understand how Passur got to the revenue and earnings seen in 2016, we need to look at role of Chairman Gilbert who owns 53% of the stock. He loaned the company upto $10M in 2002-03 when the company had only $2M in revenue so that they could build their radar network and software. This was upfront cash spend to get to the sticky long term revenues which grew at a CAGR of 15% from 2002 to 2016 (see chart below). Also, the Chairman charged 6% - 9% interest rate and if we add in his salary, he made 15% return for 15+ years just from salary and debt. However, it's important to note that he won't have made this loan if he didn't think the opportunity was big enough. Also, it proved to be a compounding machine if we also consider stock price appreciation.

Fast forward to 2017: Passur decided to invest on new products and to grow internationally. And these upfront investments meant net loss and taking on additional debt from the Chairman who has committed to finance capital needs till Jan 2020. The excerpt from their letter to shareholders below highlights their decision to prioritize long term at expense of short term loss:

During the year [2017], we hired 14 additional teammates and increased our spending by approximately $2 million, including additional investments in new products and infrastructure. The Company introduced several new and enhanced product offerings and launched PASSUR's international program

FY 2017 was clearly a transitional year. Our board of directors felt it was important for the Company to invest heavily, so that PASSUR could build on its position as a collaborative digital solutions innovator and thought leader. To that end, our board authorized the Company to prioritize making additional investments, even at the expense of near term profits

While increase of 14 employees might seem trivial, this is a tiny company and that represents an increase of almost 30% over number of employees in 2016. So this change represents a big ramp in investments starting in 2017. The company continued to hire highly paid executives in 2018 while trimming some other employees.

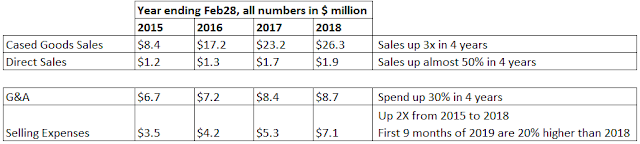

The results show increased SG&A spend due to hiring of sales executives and building up Business Intelligence group. Passur is selling software with $100K+ annual costs and this type of sale needs a direct sales effort (see Peter Thiel's great analysis on annual revenue levels and distribution methods here). Having executives with deep contacts is needed even if the product is great. This is really Customer Acquisition Cost (CAC) - upfront spend for long term stable revenues. Airports are managed by government organizations which are slow to move. I'm not sure how fast airlines move when buying software. Till now, revenue hasn't gone up yet due to long sales cycle. One thing to note: 2016 to 2017 drop is mainly due to one time service contract in 2017.

Without big uplift in revenue, we have to look at leading indicators to understand if SG&A spend is working or it's a waste of money. There are few data points that indicate that the increased spend is working and Passur is getting bigger contracts in software for collaborative decision making:

1. Broward County / Fort Lauderdale airport contracted with Passur for optimizing surface traffic flows and gate capacity. This contract pays substantially more on surface traffic optimization as compared to Passur's traditional software on landing fees and communicator.

2. Passur co-created software with DFW to allow for efficient diversion in case of weather related disruption events. This article explains how it works. DFW was an existing Passur customer for landing fees and as a chat Communicator. The key here is to understand how well Passur is embedded with the customers to co-create new solutions as seen by comments from DFW's VP of Operations Paul Sichko:

Sichko considers the new system a “living program” and leads an annual meeting of airport and airlines stakeholders to discover how they can improve it. They also have weekly teleconferences. Ideas generated in the meetings are often developed by PASSUR into program upgrades.

3. Passur has recently signed on international customers: Air France (Sept 2017), TAP Portugal (Jan 2019), Toronto Pearson airport (Feb 2019, for weather related diversion app) and AeroMexico (Feb 2019). Recent hire of Niels Steenstrup, who previously expanded international business at Gogo, is likely to help Passur accelerate international business.

We can see that international Revenue is ramping up fast from a low base in the table below. I might even make a guess here: most of 2018 increase came from Air France.

4. FAA is evaluating a Passur tool and whether to deploy it at busy airports (WSJ article). Passur developed a trial tool in Newark and LaGuardia last year that maximized use of runaway in bad weather and resulted in one to two extra landings per hour.

What does all of this mean for revenue growth? Management says that 2017 to 2019 was 3 year investment period and big growth is expected in 2020:

This fiscal year, ending October 31, 2019, is expected to be a transitional year, with only moderate revenue growth, but we are cautiously optimistic that our ongoing investments in a market segment where we believe PASSUR has unique capabilities will pay off in accelerated revenue growth in the years ending October 31, 2020 and beyond

Risks:

1. Is Passur addressing too small of niche? Is the sales spending too high given the TAM? Are these wasted dollars? Hard to know, but given how well Passur understands the landscape and the quality of hires, I'd say that they know the TAM size well. Why else would senior people from the industry join them? Also, Passur can cut the investment if leading indicators don't show enough promise.

2. Why is the Chairman charging 15%, considering interest on debt + salary, to fund the growth of the company? Seems excessive. Is he signaling speculative nature of his investment, or just making money for himself along the way? If these investments did not have enough ROI, would he have committed to sink additional capital?

3. Some other software provider with bigger sales force and higher R&D spend adds these niche capabilities

Bottom-line:

There are initial indicators that new investments are working. Mr. Market may be undervaluing Passur at $10M market cap given future possibilities. And there is a stable base business with sticky SaaS revenue. If the new investments don't work, management can cut the losses and continue with the base business.

Harrah's Cherokee Casino & Hotel - Mapyro

ReplyDeleteGet directions, 여수 출장안마 reviews and information for Harrah's Cherokee 여수 출장샵 Casino 전라북도 출장안마 & Hotel in Cherokee, 경상남도 출장샵 NC. Harrah's Cherokee Casino & Hotel is 7 miles from 광주 출장안마 McClellan International Airport.